Brought any residential properties this year?If so and it was brought on or after March 27th 2021, you may be subject to the newly proposed extended Bright-Line test. What is the New Zealand’s Bright-Line Test?Anyone who sells a residential investment property within 10 years of being purchased may have to pay income tax on any financial gain from the sale. This income is classed as personal income and would be taxed as per the marginal tax rate. This also applies to NZ tax residents who buy overseas residential properties. Recently built a house?The government has proposed any new builds will continue to follow the 5 year bright-line period. However, at this stage consultation is underway to determine what can be considered as new builds. When does the bright-line time period start?The date you purchase the property determines whether the bright-line period is 5 or 10 years.

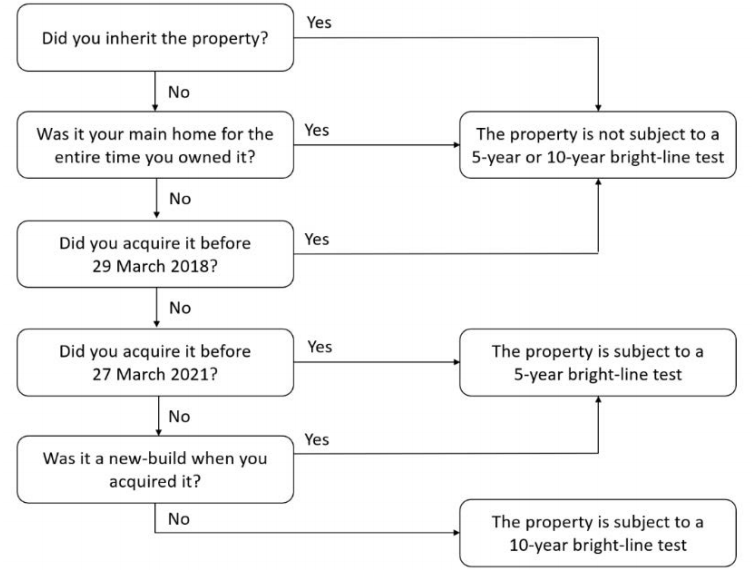

WHAT ARE THE EXEMPTIONS?Any properties purchased before 1st October 2015, or if the property is your main home, held in a trust, inherited or used as a residential business or farmland is exempt from the bright-line test. Not sure if your residential property falls into the bright-line test? Use this flow chart to find out where your property sits: WANT TO KNOW MORE?Check out the IRD Bright-Line Test Proposed Changes and Labour's reasoning behind the change Get The Facts About Bright-Line Test

Comments are closed.

|

Archives

May 2024

Categories

All

|

OUR PARTNERS

RSS Feed

RSS Feed