LATEST NEWSLETTERAs another financial year has drawn to a close, we are thrilled to bring you the latest updates and insights, including new tax regulations and essential information on FBT rules and directors' responsibilities. With the growing number of business owners, it is vital to stay informed and steer these changes effectively. 2024 CLIENT QUESTIONNAIRES Our comprehensive 2024 Client Questionnaires are ready for completion. Designed to various industries, have six distinct forms to match your specific business enterprise. Choose from the button links below:

AEWV WORK VISA CHANGESWelcome to another insightful episode of #CaffeineandCoinswithCristina! Today, let's dive into the significant changes happening with the Accredited Employer Work Visa (AEWV) in New Zealand. It's crucial to grasp how these shifts will impact both visa holders and employers. If you're in the AEWV realm, brace yourself for potential alterations in your stay duration and visa prospects. For instance, those with AEWVs issued before June 21, 2023, working in ANZSCO level 4 and 5 roles, might face adjusted stay limits unless on a residency pathway.

Thinking of a new AEWV application? Get ready for heightened work experience and qualification standards, including showcasing English proficiency for ANZSCO level 4 and 5 positions. Some roles now offer shorter visa lengths, with a max continuous stay of three years. Don't fret if your job meets specific exemptions like being on the Green List or exceeding wage criteria. Employers, too, confront stricter checks, ensuring migrant workers meet requisite qualifications, providing at least 30 hours of weekly work, and partnering with Work and Income for specific roles. Non-compliance could lead to accreditation hiccups. Stay tuned for franchisee accreditation tweaks coming in 2024, promising tailored options based on business needs. These changes strive for a fairer, streamlined work visa system. SOURCE Hello, financial enthusiasts! 🚀☕️

We're thrilled to bring you the latest episode of Caffeine and Coins with Cristina. Dive into a world of insightful financial wisdom, market updates, and essential tips tailored for both the savvy investor and the curious newcomer. This episode is packed with the juicy insights you've been waiting for! 2023 Recap: Despite challenges like high inflation and rising interest rates, the NZX 50 pulled through with a modest gain of 2.6%, marking a victory against the odds. Our Pro Stock Picks team shone bright, securing a silver medal with a 1.8% return by focusing on quality companies with robust earnings and reliable dividends. 2023 Stock Performance Overview:

A mixed outcome, indeed, but a testament to our strategic picks and the resilience of these companies. Introducing Our 2024 Top Picks:

These companies represent a blend of stability, growth potential, and industry leadership. They're our top choices for navigating the complex market landscape of 2024. Disclaimer: The information shared in this episode and blog post is not financial advice but a collection of thoughts and analyses based on data from the New Zealand Herald and our insights. Always conduct your research and consult with financial professionals before making investment decisions. Stay Connected: Don't miss out on future insights and updates. Follow us on Facebook to join our growing community of informed investors. Source: Craig's Investment Partners #CaffeineAndCoins #InvestmentInsights #FinancialSuccess #NewEpisodeAlert #FinanceFrenzy #CaffeineAndCoinswithCristina #FiveStockPicks Farming transcends being just a profession; it embodies a passion that necessitates a mix of hard work, dedication, and vision. We're excited to spotlight the success of Kenneth and Den Bedrijo, the driving forces behind Alkenz Dairy Ltd in Invercargill, through our latest 'success stories' video. Their journey is a testament to what can be achieved with a strong partnership and the right financial guidance. At Apex Accountancy, we pride ourselves on offering more than just accounting services; we are partners in our clients' success. Whether you're in Queenstown, Invercargill, or anywhere in New Zealand, our team is ready to support your business ambitions with tailored financial advice and services.

If you're aspiring to grow your business and carve out your own success story, let Apex Accountancy be the support you need. Contact our friendly team today and let us help you achieve your business goals. Discover the journey of Alkenz Dairy Ltd and be inspired by the achievements of Kenneth and Den Bedrijo. Your success story starts with the right partnership, and Apex Accountancy is here to make that happen. Expert Insights from Caffeine & Coins with CristinaWelcome back to another episode of "Caffeine & Coins with Cristina," where we blend financial wisdom with your favorite cup of coffee. In our current economic climate, marked by the Covid-19 pandemic's profound impact, we're seeing a significant shift in debt collection dynamics, including a rise in winding-up proceedings, both in New Zealand and globally.

Understanding Insolvency: A Two-Pronged Approach Insolvency can be understood through two primary financial scenarios:

Support from the Inland Revenue Department (IRD) In these challenging times, the IRD steps in to offer crucial support to businesses impacted by Covid-19 through various financial relief options:

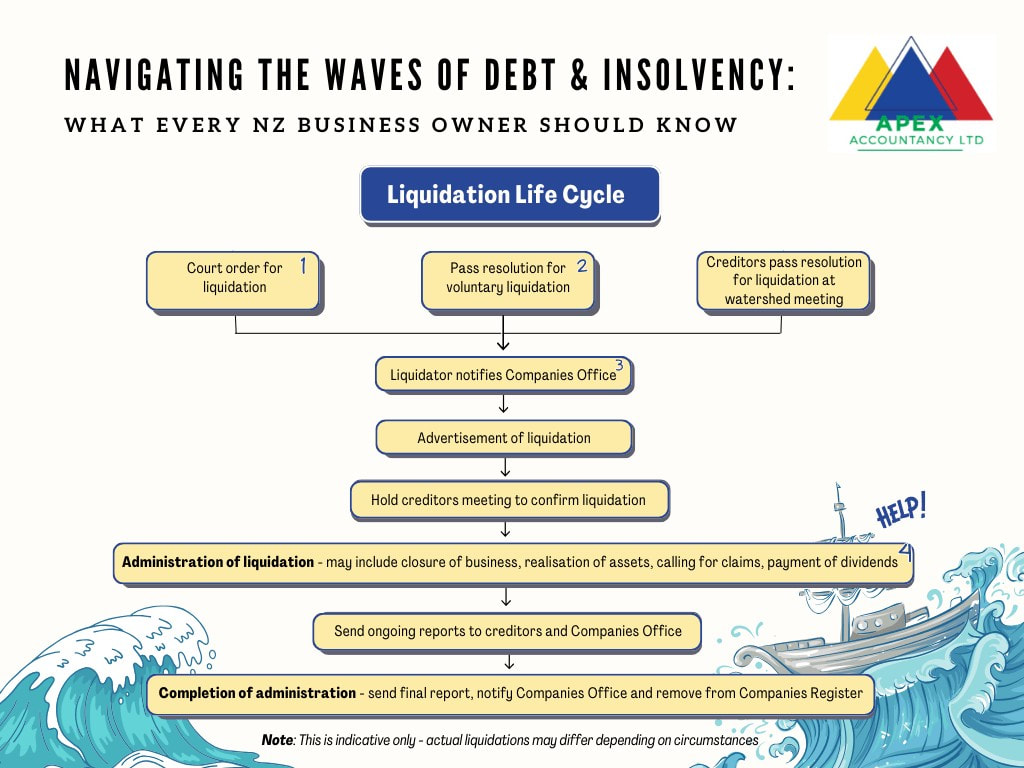

Additionally, the IRD holds the discretion to write off debts deemed irrecoverable, aligning with the efficient use of Inland Revenue's resources. Remission of Penalties and Interest In certain situations, penalties and interest may be waived, particularly when circumstances are beyond control, as part of the IRD's commitment to maximizing net revenue. Voluntary Liquidation: A Proactive Option Faced with formal demands from the IRD, companies can opt for voluntary liquidation, allowing directors and shareholders to maintain control. However, failing to act promptly might result in the IRD appointing a liquidator, diminishing the directors' control and necessitating cooperation with a Court-appointed liquidator. Choosing the Right Path Forward Deciding between involuntary and voluntary liquidation can be complex. Engaging a licensed insolvency practitioner can provide clarity and guidance in navigating these choices, minimizing impacts on the business. Key Considerations in Debt and Insolvency

In financially uncertain times, proactive measures and informed decisions are key. Seeking professional advice is crucial in safeguarding your business's future. Government Agencies for Assistance In New Zealand, two primary agencies offer support in insolvency matters:

Both agencies offer tailored support to help secure your business's future. For more information, visit Insolvency and Trustee Service or the Inland Revenue Department (IRD). Stay tuned for more in-depth analyses and clear guides on complex financial issues, helping you make well-informed decisions for your business. If you need help with this or any other tax or financial issues please get in touch. Launch of Our Queenstown Branch!We are thrilled to announce the official opening of our Queenstown branch, extending our services to our valued clients and prospective partners in the Otago region. This expansion is a testament to our commitment to being readily accessible to meet your needs. Visit us at our new office location: Level 3, Craigs Investment Building Mountain Club, 36 Grant Road, Five Mile Centre, Queenstown 9300. Our dedicated team is eager to welcome you and address any inquiries or concerns you may have. Feel free to drop by, and we look forward to serving you at our Queenstown branch! Year-End Financial Planning for March 2024

Office Holiday Hours & Contact INFOAs the festive season is fast approaching, we would like to inform you of our Christmas shutdown period. The office will be closed from 22 December 2023 to 9 January 2024, and we will resume operations on 10 January 2024. During this holiday period, for any urgent inquiries, please feel free to reach out to Cristina Canard at [email protected] or on her mobile at 022 076 7577. We take this opportunity to extend warm holiday wishes to each member of our Apex Family. Your continued partnership is deeply appreciated, and we look forward to another prosperous year together. Wishing you joy, peace, and success during this holiday season! Best regards, Apex Accounting Team Our December newsletter is bursting with lots more information. Please feel free to read the whole newsletter via the button link.

It is a prime time to fine-tune your tax strategy. Consider the following practical tips to optimize your tax position:

Tax Credits and Incentives Did you know that there are existing tax credits and incentives? These are available for individuals or a company, so understanding these opportunities can make a real difference. Individual – Tax Credits and Incentives 1. Credits for taxes withheld or paid

2. Imputation Credits: The imputation system is designed to prevent double taxation on company profits. Here's how it works: a company attaches imputation credits (reflecting tax paid at the company level) to cash and non-cash dividends, as well as taxable bonus issues, distributed to shareholders. Shareholders then use these imputation credits to lower their own tax liability on the company’s dividends. Shareholders consider both the dividends and imputation credits as assessable income, with a credit allowed against their income tax liability matching the attached imputation credits. However, non-resident shareholders cannot utilize imputation credits. 3. Personal Tax Credits: Individuals earning between NZD 24,000 and NZD 48,000 annually and meeting specific criteria qualify for an 'independent earner' tax credit of NZD 520. If the income surpasses NZD 44,000, the yearly entitlement diminishes by 13 cents for every additional dollar earned until reaching NZD 48,000, where the credit is entirely phased out. 4. Charitable Donations: The credit for charitable donations allows individuals to claim a 33.3% tax credit on eligible contributions, capped at their taxable income. 5. Working for Families Tax Credit (WFTC): The 'Working for Families' tax credit is available to individuals, offering an in-work payment for families with dependent children. Geared towards low and middle-income families, these credits are typically disbursed in fortnightly instalments, with an annual reconciliation for any under or overpayment. The amounts received are non-taxable. Family scheme income, defined as the net income, forms the basis for entitlement and tax credit calculations under the family scheme. Corporate – Tax Credits and Incentives 1. Foreign Tax Credits: When a New Zealand resident company earns income abroad that falls under New Zealand income tax, the company is typically eligible for a credit corresponding to the foreign income tax paid on that revenue. Foreign tax credits are applicable only when the taxpayer is in a tax-paying position. Failure to claim foreign tax credits in the current year results in their forfeiture. 2. Inbound Investment Incentives: New Zealand offers targeted tax incentives to promote the influx of investment funds into the country. Legislation actively supports foreign venture capital investment in unlisted New Zealand companies. Profits gained by specific non-residents from selling shares in New Zealand unlisted companies, provided these companies do not engage in certain prohibited activities as their primary focus, are exempt from income tax. These rules are applicable to foreign investors residing in all countries with which New Zealand has a Double Tax Agreement (except Switzerland) and who invest in New Zealand venture capital opportunities. 3. Trans-Tasman Imputation: Elective rules enable groups of companies spanning both New Zealand and Australia (trans-Tasman groups) to affix imputation credits (reflecting New Zealand tax paid) and franking credits (reflecting Australian tax paid) to dividends distributed to shareholders. This system permits fully owned groups of Australian and/or New Zealand companies to amalgamate solely for imputation purposes. Such groups, comprising members from both Australia and New Zealand, are referred to as trans-Tasman imputation groups (TTIGs). New Zealand companies within a trans-Tasman group maintain a distinct 'resident imputation subgroup' account. 4. Research and Development (R&D) Tax Incentive: Eligible research and development (R&D) expenditures can trigger a 15% tax credit. Core R&D activities qualifying for a tax credit involve conducting activities systematically, with the primary goal of generating new knowledge or enhancing processes, services, or goods, and to resolve scientific or technological uncertainties. The eligible R&D expenditure encompasses specific categories such as salary and wage costs, overhead costs, asset depreciation, and direct expenditure on consumables and materials. Certain activities and costs, however, may be excluded from the tax incentive. This incentive is accessible to taxpayers with R&D expenditure falling within a set range, ranging from a minimum of NZD 50,000 to a maximum of NZD 120 million annually, unless special approval is obtained to exceed the cap. The rules also provide limited cash refundability for certain entities facing losses. (Source: New Zealand - Individual - Other tax credits and incentives (pwc.com); New Zealand - Corporate - Tax credits and incentives (pwc.com)) We have written a lot more about Tax Optimisation Tips in our December newsletter. Click the button to download the full newsletter. Introduction: Think of cash flow as the fuel for your business vehicle. Without it, just like a car, your business can't move forward. Let’s explore how to maintain a steady flow of this essential resource.

Cash Flow: The Business Fuel Cash flow is the money coming in and going out of your business. Positive cash flow, like a full fuel tank, ensures you can reach your destinations – paying expenses, growing your business, and investing in new opportunities. Negative cash flow, on the other hand, is like running on empty, putting your business at risk of stalling. Strategies for a Better Cash Flow:

Your Navigation Partner is Apex Accountancy - we're like your GPS and fuel gauge combined, helping you maintain a healthy cash flow to smoothly drive your business forward. Reach out to us for tailored strategies that ensure your business tank is always full. We have put together another informative newsletter for you which includes information about many New Zealand tax and business matters including:

Schedular payments are payments made to contractors who perform certain activities. Tax is deducted from these payments but they're different to salary or wage payments. Watch this handy instructional video about schedular payments. |

Archives

May 2024

Categories

All

|

OUR PARTNERS

RSS Feed

RSS Feed