Expert Insights from Caffeine & Coins with CristinaWelcome back to another episode of "Caffeine & Coins with Cristina," where we blend financial wisdom with your favorite cup of coffee. In our current economic climate, marked by the Covid-19 pandemic's profound impact, we're seeing a significant shift in debt collection dynamics, including a rise in winding-up proceedings, both in New Zealand and globally.

Understanding Insolvency: A Two-Pronged Approach Insolvency can be understood through two primary financial scenarios:

Support from the Inland Revenue Department (IRD) In these challenging times, the IRD steps in to offer crucial support to businesses impacted by Covid-19 through various financial relief options:

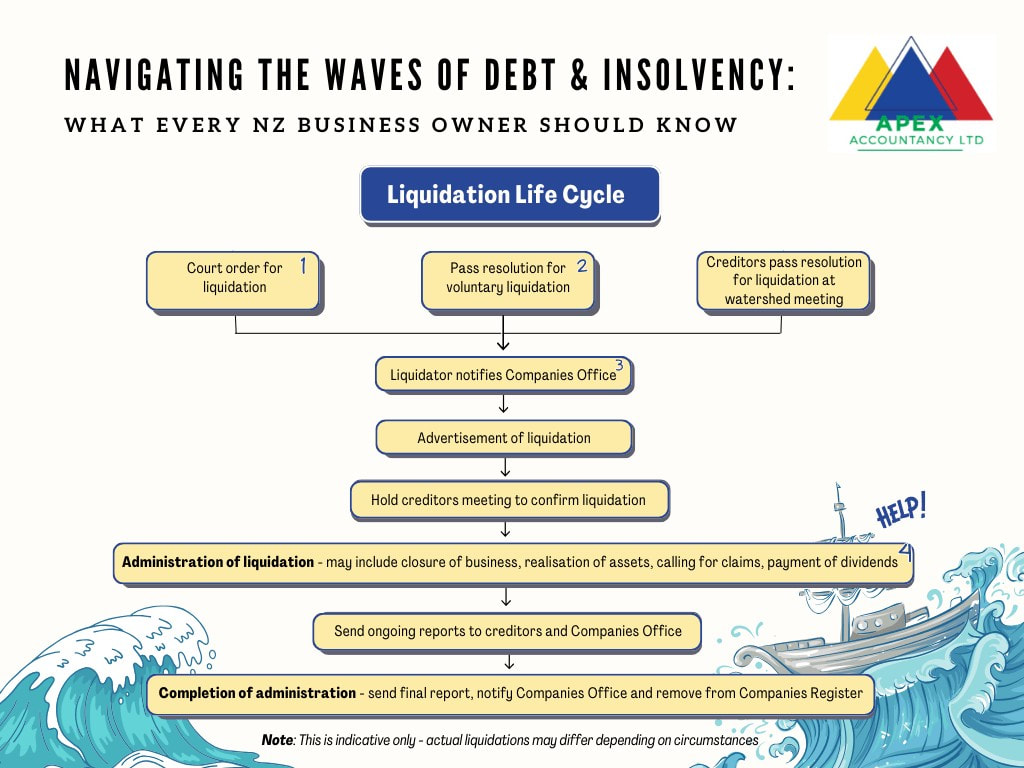

Additionally, the IRD holds the discretion to write off debts deemed irrecoverable, aligning with the efficient use of Inland Revenue's resources. Remission of Penalties and Interest In certain situations, penalties and interest may be waived, particularly when circumstances are beyond control, as part of the IRD's commitment to maximizing net revenue. Voluntary Liquidation: A Proactive Option Faced with formal demands from the IRD, companies can opt for voluntary liquidation, allowing directors and shareholders to maintain control. However, failing to act promptly might result in the IRD appointing a liquidator, diminishing the directors' control and necessitating cooperation with a Court-appointed liquidator. Choosing the Right Path Forward Deciding between involuntary and voluntary liquidation can be complex. Engaging a licensed insolvency practitioner can provide clarity and guidance in navigating these choices, minimizing impacts on the business. Key Considerations in Debt and Insolvency

In financially uncertain times, proactive measures and informed decisions are key. Seeking professional advice is crucial in safeguarding your business's future. Government Agencies for Assistance In New Zealand, two primary agencies offer support in insolvency matters:

Both agencies offer tailored support to help secure your business's future. For more information, visit Insolvency and Trustee Service or the Inland Revenue Department (IRD). Stay tuned for more in-depth analyses and clear guides on complex financial issues, helping you make well-informed decisions for your business. If you need help with this or any other tax or financial issues please get in touch. It is a prime time to fine-tune your tax strategy. Consider the following practical tips to optimize your tax position:

Tax Credits and Incentives Did you know that there are existing tax credits and incentives? These are available for individuals or a company, so understanding these opportunities can make a real difference. Individual – Tax Credits and Incentives 1. Credits for taxes withheld or paid

2. Imputation Credits: The imputation system is designed to prevent double taxation on company profits. Here's how it works: a company attaches imputation credits (reflecting tax paid at the company level) to cash and non-cash dividends, as well as taxable bonus issues, distributed to shareholders. Shareholders then use these imputation credits to lower their own tax liability on the company’s dividends. Shareholders consider both the dividends and imputation credits as assessable income, with a credit allowed against their income tax liability matching the attached imputation credits. However, non-resident shareholders cannot utilize imputation credits. 3. Personal Tax Credits: Individuals earning between NZD 24,000 and NZD 48,000 annually and meeting specific criteria qualify for an 'independent earner' tax credit of NZD 520. If the income surpasses NZD 44,000, the yearly entitlement diminishes by 13 cents for every additional dollar earned until reaching NZD 48,000, where the credit is entirely phased out. 4. Charitable Donations: The credit for charitable donations allows individuals to claim a 33.3% tax credit on eligible contributions, capped at their taxable income. 5. Working for Families Tax Credit (WFTC): The 'Working for Families' tax credit is available to individuals, offering an in-work payment for families with dependent children. Geared towards low and middle-income families, these credits are typically disbursed in fortnightly instalments, with an annual reconciliation for any under or overpayment. The amounts received are non-taxable. Family scheme income, defined as the net income, forms the basis for entitlement and tax credit calculations under the family scheme. Corporate – Tax Credits and Incentives 1. Foreign Tax Credits: When a New Zealand resident company earns income abroad that falls under New Zealand income tax, the company is typically eligible for a credit corresponding to the foreign income tax paid on that revenue. Foreign tax credits are applicable only when the taxpayer is in a tax-paying position. Failure to claim foreign tax credits in the current year results in their forfeiture. 2. Inbound Investment Incentives: New Zealand offers targeted tax incentives to promote the influx of investment funds into the country. Legislation actively supports foreign venture capital investment in unlisted New Zealand companies. Profits gained by specific non-residents from selling shares in New Zealand unlisted companies, provided these companies do not engage in certain prohibited activities as their primary focus, are exempt from income tax. These rules are applicable to foreign investors residing in all countries with which New Zealand has a Double Tax Agreement (except Switzerland) and who invest in New Zealand venture capital opportunities. 3. Trans-Tasman Imputation: Elective rules enable groups of companies spanning both New Zealand and Australia (trans-Tasman groups) to affix imputation credits (reflecting New Zealand tax paid) and franking credits (reflecting Australian tax paid) to dividends distributed to shareholders. This system permits fully owned groups of Australian and/or New Zealand companies to amalgamate solely for imputation purposes. Such groups, comprising members from both Australia and New Zealand, are referred to as trans-Tasman imputation groups (TTIGs). New Zealand companies within a trans-Tasman group maintain a distinct 'resident imputation subgroup' account. 4. Research and Development (R&D) Tax Incentive: Eligible research and development (R&D) expenditures can trigger a 15% tax credit. Core R&D activities qualifying for a tax credit involve conducting activities systematically, with the primary goal of generating new knowledge or enhancing processes, services, or goods, and to resolve scientific or technological uncertainties. The eligible R&D expenditure encompasses specific categories such as salary and wage costs, overhead costs, asset depreciation, and direct expenditure on consumables and materials. Certain activities and costs, however, may be excluded from the tax incentive. This incentive is accessible to taxpayers with R&D expenditure falling within a set range, ranging from a minimum of NZD 50,000 to a maximum of NZD 120 million annually, unless special approval is obtained to exceed the cap. The rules also provide limited cash refundability for certain entities facing losses. (Source: New Zealand - Individual - Other tax credits and incentives (pwc.com); New Zealand - Corporate - Tax credits and incentives (pwc.com)) We have written a lot more about Tax Optimisation Tips in our December newsletter. Click the button to download the full newsletter. Introduction: Think of cash flow as the fuel for your business vehicle. Without it, just like a car, your business can't move forward. Let’s explore how to maintain a steady flow of this essential resource.

Cash Flow: The Business Fuel Cash flow is the money coming in and going out of your business. Positive cash flow, like a full fuel tank, ensures you can reach your destinations – paying expenses, growing your business, and investing in new opportunities. Negative cash flow, on the other hand, is like running on empty, putting your business at risk of stalling. Strategies for a Better Cash Flow:

Your Navigation Partner is Apex Accountancy - we're like your GPS and fuel gauge combined, helping you maintain a healthy cash flow to smoothly drive your business forward. Reach out to us for tailored strategies that ensure your business tank is always full. In our December Newsletter we teach you about all the tax news and updates you need to know as a business owner in New Zealand. These include: Provisional taxesLearn more about provisional taxes and payment due dates for 2023. What are the available payment arrangements, and how can you set set them up? Goals for 2023Identify the tips and tricks on how to handle cash flows. This about getting business coaching to discuss business profitability. Xero TrainingLet us know what you want to learn. We offer Xero training to help you and your business. Christmas ExpensesIt's the holiday season, and it's time for the annual Christmas work party, gift giving, cash bonuses, and more. But do you know which entertainment expenses you can deduct for your business, and which may be subject to Fringe Benefit Tax (FBT)? Our December newsletter has details about all these topics and much more too!

Calculating the breakeven point is a key financial analysis tool used by business owners.

Once you know the fixed and variable costs for the product your business produces or a good approximation of them, you can use that information to calculate your company's breakeven point. Small business owners can use the calculation to determine how many product units they need to sell at a given price point to break even. The Breakeven Point A company's breakeven point is the point at which its sales exactly cover its expenses. To compute a company's breakeven point in sales volume, you need to know the values of three variables:

How to Calculate Breakeven Point In order to calculate your company's breakeven point, use the following formula: Fixed Costs ÷ (Price - Variable Costs) = Breakeven Point in Units In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Note that in this formula, fixed costs are stated as a total of all overhead for the firm, whereas Price and Variable Costs are stated as per unit costs—the price for each product unit sold. The denominator of the equation, price minus variable costs, is called the contribution margin. After unit variable costs are deducted from the price, whatever is left—the contribution margin—is available to pay the company's fixed costs. Your credit record is an important part of your financial fingerprint in New Zealand and can affect how companies treat you, for example when you want to borrow money or get insurance. This month we talk about checking and correcting your own credit report. HOW DO YOU CHECK YOUR CREDIT RECORD?You can check your credit information for free, but if you want the information in a hurry you have to pay for a report. The New Zealand government links to the main credit reporting companies in NZ. HOW DO YOU CORRECT YOUR CREDIT REPORT?Credit reporters must take reasonable steps to ensure the information they hold is accurate, and promptly correct any errors they become aware of.

If you tell a credit reporter that your report contains an inaccuracy, the credit reporter must, if appropriate, take steps to correct it. They will usually check the information you provide with the source − for example, the credit provider who submitted a default. Learn more about how to do this on the New Zealand Privacy Commissioner website. COVID-19 Payment reviewThe Inland Revenue have nearly completed the applications for the COVID-19 Support Payment and are now reviewing the accounts of a sample of their customers who received one or more of the following:

The review is to make sure customers met the relevant eligibility criteria and have used the payments in line with the terms and conditions. If the IRD find you were ineligible or have not used the payments in line with the terms and conditions, they may act to recover these. To check the eligibility criteria visit the website by clicking the link. The message here is to ensure to send your expenses reconciliation to your accountant. Hidden Economy real estate campaignInland Revenue started the campaign because a number of real estate agents appeared to be:

The message here is do not claim personal expenses and common errors that real estate agents make. If you have questions about any of these issues please do not hesitate to get in touch with us here at Apex Accountancy.

Managing Your Cash Flow

They often say cash flow is king and well there quite right. It’s nice to have profit but cash flow is what will make or break your business. With the Pandemic causing chaos in the business world managing your cash flow is now more important than ever. First off, cashflow often gets confused for profit, yet it’s a little bit different. Profit – cash left over once your expenses from your sales revenue has been taken out. Cashflow – Cash that flows in and out of your business and not into your pocket. Cash flow is used to cover your expenses, both current and future. It’s what grows your business. What’s the secret to managing your cashflow? Books – Make sure your records are up to date. Record all your cash flow information regularly. This is a big must as you need to know if you have more expenses than income or if you have enough cashflow happening to buy supplies. Setting up your bookkeeping and taking care of it regularly means you can check your not only your cash flow but your complete financial state at any time. Cash flow forecast – Sounds intimidating I know. Simply put this an estimation of the amount of money you expect to flow in and out of your business. By forecasting your cash flow you have the chance to identify any potential or current issues before they turn into major ones. What a forecast can tell you:

Don’t Forget the Tax Man – Tax sneaks up on you if you are not prepared. Make sure you work this into your forecast.

Customers - Useful to have for every business. Invoices, a necessary customer payment prompt. Having a strategy will help make creating and sending invoices easier. Set up a system that works for you. How? Here are a few pointers:

Keep it separate – Don’t mix your personal and business finances together. Tempting I know. This will make it much harder to work out what your cash flow is. Also gives you a false cash flow forecast. Set up your pay properly so you can pay yourself, any excess cash can then be identified easier and used to grow your business. Set up a cash reserve - Is there a certain time of year where you struggle to pay bills? Save for that rainy day. Start building up a cash reserve now, so you're prepared. Yes, it may mean cutting back a bit for now on what you may pay yourself, but it will be worth it to have that cash reserve. Bonus too, if any unexpected events arise, for example COVID, you will have a little bit of cash to help you out. Plus watching the cash reserve grow will help build your confidence and strengthen finances. Need an extra hand? Business stuff can be complex, so if in doubt ask us for help that’s why we’re here. Xmas time! Time to dust off that Xmas Tree and deck the halls for that end of year Xmas work party.

Stock up on those employer Xmas gift hampers!! Woah, hold up, before you get too excited with the festive season, do you know what entertainment expenses and Xmas gifts you can claim back on, and which ones may incur FBT. There are 3 main types of entertainment expenses that your Xmas staff party, employee gift hamper and even client gifts can fall into. Your dream business is up and running, money is coming in. Problem is how do you pay yourself for all that hard work? Too much, and you won’t have enough to cover business expenses, taxes and overheads, too little and you won’t have enough to cover personal expenses…so what’s the right balance?

|

Archives

May 2024

Categories

All

|

OUR PARTNERS

RSS Feed

RSS Feed