|

In our December Newsletter we teach you about all the tax news and updates you need to know as a business owner in New Zealand. These include: Provisional taxesLearn more about provisional taxes and payment due dates for 2023. What are the available payment arrangements, and how can you set set them up? Goals for 2023Identify the tips and tricks on how to handle cash flows. This about getting business coaching to discuss business profitability. Xero TrainingLet us know what you want to learn. We offer Xero training to help you and your business. Christmas ExpensesIt's the holiday season, and it's time for the annual Christmas work party, gift giving, cash bonuses, and more. But do you know which entertainment expenses you can deduct for your business, and which may be subject to Fringe Benefit Tax (FBT)? Our December newsletter has details about all these topics and much more too!

Tax relief for businesses hit by severe July weatherThe Government has made an Order in Council declaring the series of adverse weather fronts that crossed New Zealand between 11 July and 31 July 2022 to be an emergency event and allows Inland Revenue to waive interest charges on late payments of tax for business affected by that emergency event. The Tax Administration (July Adverse Weather Event) Order 2022 allows Inland Revenue to waive use of money interest for late payment of taxes. The emergency event applies to people whose businesses in the districts of Canterbury, Gisborne, Northland, Otago, and Wairoa have been affected by floods, damaging high winds, and disruption to infrastructure. The Order is now in effect and will expire on 30 September 2022. Businesses affected by the floods are urged to contact their tax agent if they would like to take advantage of the interest remission measure. Taxpayers will be able to apply to have late payment interest waived once they have filed their returns and paid due taxes. Different rules apply in cases of financial hardship. Provisional Tax DUE SOONProvisional tax is due on August 28, 2022. Provisional tax helps you manage your income tax. You pay it in instalments during the year instead of a lump sum at the end of the year. You'll have to pay provisional tax if you had to pay more than $5,000 tax at the end of the year from your last return. It's payable the following year after your tax return. For example, if your residual income tax from your 2022 return is more than $5,000, then you'll need to pay provisional tax during the 2023 tax year. Provisional taxpayers often earn:

There are some situations where you may need to pay provisional tax on your reportable income. Reportable income is income information that Inland Revenue receives regularly from a third party (e.g. an employer, a bank, etc) for an individual and a tax year. This includes:

These can be due to:

Please budget for your August 28, 2022 Provisional tax. Calculating YOUR Charge out rateIn order to calculate an accurate charge out rate there are many factors you need to take into account. From your target income to the amount of hours you can manage ANZ has all the tips and tricks. INFLATION RATE - NOW 7.3%The consumers price index (CPI) is a measure of inflation for New Zealand households. It records changes in the price of goods and services. It influences interest rates and is used to calculate changes to benefit payments.

COVID-19 Payment reviewThe Inland Revenue have nearly completed the applications for the COVID-19 Support Payment and are now reviewing the accounts of a sample of their customers who received one or more of the following:

The review is to make sure customers met the relevant eligibility criteria and have used the payments in line with the terms and conditions. If the IRD find you were ineligible or have not used the payments in line with the terms and conditions, they may act to recover these. To check the eligibility criteria visit the website by clicking the link. The message here is to ensure to send your expenses reconciliation to your accountant. Hidden Economy real estate campaignInland Revenue started the campaign because a number of real estate agents appeared to be:

The message here is do not claim personal expenses and common errors that real estate agents make. If you have questions about any of these issues please do not hesitate to get in touch with us here at Apex Accountancy.

What are the current guidelines?At present residential investment property owners can claim interest on loans related to the property as a claimed expense. Thereby reducing the amount of tax needed to be paid. What are the pROposed changes?While the government is still in consultation on the precise details of the proposed change, what we do know from 1st October 2021 the proposal is set to restrict and eventually, overtime, remove the interest deductions on residential property income.

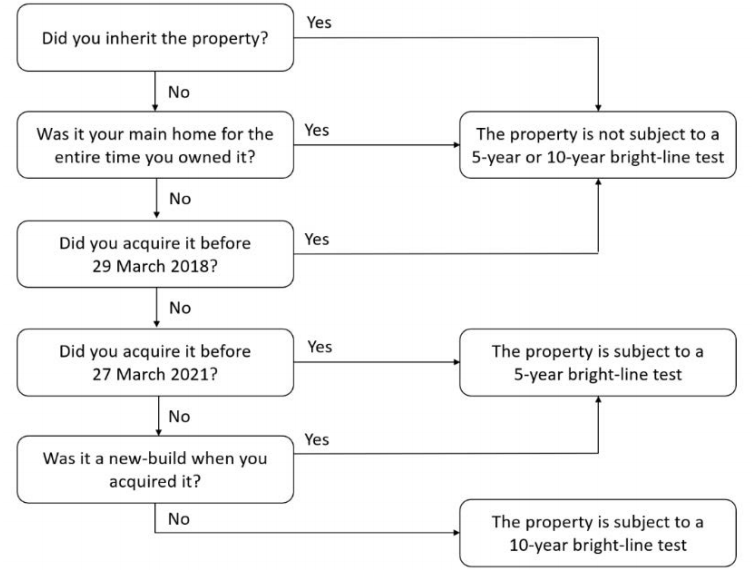

Brought any residential properties this year?If so and it was brought on or after March 27th 2021, you may be subject to the newly proposed extended Bright-Line test. What is the New Zealand’s Bright-Line Test?Anyone who sells a residential investment property within 10 years of being purchased may have to pay income tax on any financial gain from the sale. This income is classed as personal income and would be taxed as per the marginal tax rate.

This also applies to NZ tax residents who buy overseas residential properties. What's best for your business? Within the Covid levels there are a range of financial support options to get you through. Resurgence Support Payment (RSP)Available during Levels: 2, 3, 4 Does your revenue drop every time there’s a change in COVID-19 levels? RSP is a payment available to support business or organisations that are facing a reduction in revenue created by COVID-19 alert level increases. Are you eligible? If you have been in business for at least 6 months and have experienced a drop of 30% in revenue over a 7-day period after an alert level increase, not just covid in general, you may be eligible for this support payment. What do you need to know? RSP is not an automatic payment support, the government will decide whether to activate if the alert level increases from level 1 for at least a week. This payment is not a loan, so does not need to be repaid. The payment must be used to help cover business expenses such as wages and fixed costs. Applications will remain open for 1 month after the return to Alert Level. Wage Subsidy SchemeAvailable during Levels: 3, 4 Worried about how you are going to pay your staff when in lockdown? Wage Subsidy March 2021 was made available to help employers pay staff and continue employment which would otherwise be impacted by February 2021 alert level changes. Are you eligible? If you are a business or self-employed and have experienced a 40% drop in revenue over a 14-day period between 28 February 2021 and 21 March 2021 due to the alert level increase you may be eligible. What do you need to know? The Wage Subsidy was made available between 4 March 2021 to 21 March 2021. You needed to be able to show that the revenue drop was due to the change in alert level, not just COVID-19 in general. Short-Term Absence PaymentAvailable during Levels: 1, 2, 3, 4 Uh, Oh, COVID-19 test downtime? If you or your employees require a COVID-19 test and miss work or are unable to work from home while waiting for the results the Short-Term Absence Payment may be what you need. Are you eligible? To be eligible, workers need to be unable to work from home and need to miss work while waiting for the test results. What do you need to know? Available to employers and self-employed workers, at all alert levels. Must be used to pay employees following the public health guidance for awaiting COVID-19 test result. Small business cash flow loan scheme (SBCS)Available during Levels: 1, 2, 3, 4 Worried about your cashflow? SBCS is a Loan provided by the government to provide cashflow support to those that have been impacted by COVID-19. Providing assistance of up to $100,000 to small businesses, sole traders and self-employed, who employ 50 or fewer full-time employees. Are you eligible? You must show at least a 30% drop in revenue due to Covid-19, measured over a 14-day period in the past 6 months What do you need to know? Applications have been extended and open until 31 December 2023. Loan is to be paid back, interest free, within two years, after this period an interest rate of 3% for a maximum term of five years. Tax and ACC supportAvailable during Levels: 1, 2, 3, 4 Struggling with your tax obligations? If due to COVID-19 you are finding it a struggle to pay your tax obligations, Inland Revenue has support schemes and options in place to help, click the link below. Worried about ACC payments? ACC levy invoices for 20/21 financial year, usually sent out in July, will now be sent out in October. More information about delayed invoices and guidance to help is available below. Business debt hibernationAvailable during Levels: 1, 2, 3, 4 Need help managing business debt? Business debt hibernation helps business and trusts affected by COVID-19 manage their debts. This government initiative helps you set up an arrangement to pay your creditors. While this arrangement is being set your creditors can’t enforce their debts. Effectively providing up to a month of protection. What do you need to know? Unfortunately, this is unavailable for Sole traders. Applications remain open until 31 October 2021. This business debt hibernation decision tool may help you decide if it’s a good option for your business: Business finance guarantee scheme (BFG)Available during Levels: 1, 2, 3, 4 Are you after a loan? Business Finance Guarantee loans that can help businesses access credit for cashflow, capital assets, and projects related from impacts caused by COVID-19. What do you need to know? Due to a change in the scheme, businesses can now use the loan to modify their premises to accommodate different alert levels or meet changing demands. As per usual loan conditions, borrows are still liable, and debt must be paid back with interest. Find Out MoreAs always there are eligibility requirements that must be meet for you to receive financial support. I’m here to help, contact me if you have any questions or want to explore your options.

For a general guide on each of the above head over to the Business Govt. NZ website. The legislation introduced last year was designed to simplify and integrate tax processes with day-to-day business. The result is a new option for managing provisional tax through accounting software, the ‘Accounting Income Method’ (AIM), which will be available to start on April 17, 2018.

What is AIM ( Accounting Income Method)? Accounting Income Method is a new provisional tax option for small businesses with annual turnover under $5 million. How does it work? MYOB, Reckon or Xero calculates the payment by using the information in your accounting software. The system will calculate provisional tax if your business is making profit. The calculation will include basic tax adjustments for depreciation, Shareholder Salary, Private Use expenditure, Debtors and Creditors, Provisions, Trading Stock and Prior Year Losses. Two key benefits of Accounting Income Method

What are the other benefits of Accounting Income Method?

Use AIM if your business turnover is 5 million, growing and the sales are unpredictable or fluctuating. Partnerships, Maori Authorities, Superannuation funds, Trusts and Portfolio Investment entities. Keep up to date with tax changes. Follow us on Facebook to learn more. |

Archives

May 2024

Categories

All

|

OUR PARTNERS

RSS Feed

RSS Feed