|

Affected by the move to Alert Level 4 on 17 August 2021 and The Current Protection Framework (Traffic Light System)?

Wage subsidy August 2021 is available throughout New Zealand to support you in paying your employees two weeks’ worth of wages. Also available if you are self-employed. What you need to know: You need to meet the eligibility criteria and meet certain obligations. This involves completing a revenue decline test to show your business has and currently is being affected by the continuation of Alert Levels and traffic light systems, from 17 August 2021. For more information head over to here to Work and Income. Your business needs to meet the eligibility criteria as outlined below and agree to meet the obligations in the declaration to be able to get a COVID-19 Wage Subsidy August 2021. It's available to all New Zealand businesses and self-employed people that meet eligibility criteria.

The full eligibility details and obligations are set-out in the declaration, which you must read and agree to when you apply for the COVID-19 Wage Subsidy August 2021. Your business may be able to get the COVID-19 Resurgence Support payment from Inland Revenue. It's to help with fixed costs like rent. You can get this as well as the COVID-19 Wage Subsidy August 2021

The Resurgence Support Payment (RSP) is a payment to help support viable and ongoing businesses or organisations due to a COVID-19 alert level increase to level 2 or higher. If your business or organisation is facing a reduction in revenue due to an alert level increase, you may be eligible for the RSP. Applications for the alert level increase announced on 17 August will open at 8am on 24 August. Your dream business is up and running, money is coming in. Problem is how do you pay yourself for all that hard work? Too much, and you won’t have enough to cover business expenses, taxes and overheads, too little and you won’t have enough to cover personal expenses…so what’s the right balance?

What are the current guidelines?At present residential investment property owners can claim interest on loans related to the property as a claimed expense. Thereby reducing the amount of tax needed to be paid. What are the pROposed changes?While the government is still in consultation on the precise details of the proposed change, what we do know from 1st October 2021 the proposal is set to restrict and eventually, overtime, remove the interest deductions on residential property income.

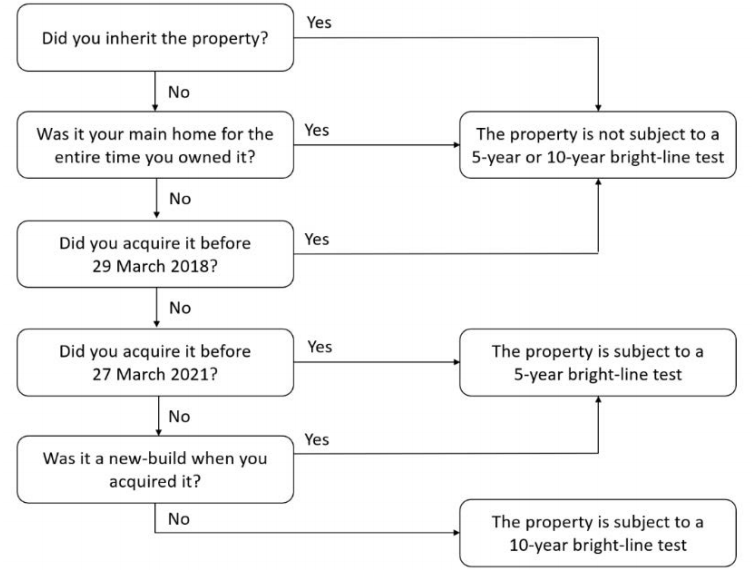

Brought any residential properties this year?If so and it was brought on or after March 27th 2021, you may be subject to the newly proposed extended Bright-Line test. What is the New Zealand’s Bright-Line Test?Anyone who sells a residential investment property within 10 years of being purchased may have to pay income tax on any financial gain from the sale. This income is classed as personal income and would be taxed as per the marginal tax rate.

This also applies to NZ tax residents who buy overseas residential properties. Super important, up to date records are needed to easily determine your tax position. Good record keeping makes your business life less stressful and more efficient by saving you time and money.

What's best for your business? Within the Covid levels there are a range of financial support options to get you through. Resurgence Support Payment (RSP)Available during Levels: 2, 3, 4 Does your revenue drop every time there’s a change in COVID-19 levels? RSP is a payment available to support business or organisations that are facing a reduction in revenue created by COVID-19 alert level increases. Are you eligible? If you have been in business for at least 6 months and have experienced a drop of 30% in revenue over a 7-day period after an alert level increase, not just covid in general, you may be eligible for this support payment. What do you need to know? RSP is not an automatic payment support, the government will decide whether to activate if the alert level increases from level 1 for at least a week. This payment is not a loan, so does not need to be repaid. The payment must be used to help cover business expenses such as wages and fixed costs. Applications will remain open for 1 month after the return to Alert Level. Wage Subsidy SchemeAvailable during Levels: 3, 4 Worried about how you are going to pay your staff when in lockdown? Wage Subsidy March 2021 was made available to help employers pay staff and continue employment which would otherwise be impacted by February 2021 alert level changes. Are you eligible? If you are a business or self-employed and have experienced a 40% drop in revenue over a 14-day period between 28 February 2021 and 21 March 2021 due to the alert level increase you may be eligible. What do you need to know? The Wage Subsidy was made available between 4 March 2021 to 21 March 2021. You needed to be able to show that the revenue drop was due to the change in alert level, not just COVID-19 in general. Short-Term Absence PaymentAvailable during Levels: 1, 2, 3, 4 Uh, Oh, COVID-19 test downtime? If you or your employees require a COVID-19 test and miss work or are unable to work from home while waiting for the results the Short-Term Absence Payment may be what you need. Are you eligible? To be eligible, workers need to be unable to work from home and need to miss work while waiting for the test results. What do you need to know? Available to employers and self-employed workers, at all alert levels. Must be used to pay employees following the public health guidance for awaiting COVID-19 test result. Small business cash flow loan scheme (SBCS)Available during Levels: 1, 2, 3, 4 Worried about your cashflow? SBCS is a Loan provided by the government to provide cashflow support to those that have been impacted by COVID-19. Providing assistance of up to $100,000 to small businesses, sole traders and self-employed, who employ 50 or fewer full-time employees. Are you eligible? You must show at least a 30% drop in revenue due to Covid-19, measured over a 14-day period in the past 6 months What do you need to know? Applications have been extended and open until 31 December 2023. Loan is to be paid back, interest free, within two years, after this period an interest rate of 3% for a maximum term of five years. Tax and ACC supportAvailable during Levels: 1, 2, 3, 4 Struggling with your tax obligations? If due to COVID-19 you are finding it a struggle to pay your tax obligations, Inland Revenue has support schemes and options in place to help, click the link below. Worried about ACC payments? ACC levy invoices for 20/21 financial year, usually sent out in July, will now be sent out in October. More information about delayed invoices and guidance to help is available below. Business debt hibernationAvailable during Levels: 1, 2, 3, 4 Need help managing business debt? Business debt hibernation helps business and trusts affected by COVID-19 manage their debts. This government initiative helps you set up an arrangement to pay your creditors. While this arrangement is being set your creditors can’t enforce their debts. Effectively providing up to a month of protection. What do you need to know? Unfortunately, this is unavailable for Sole traders. Applications remain open until 31 October 2021. This business debt hibernation decision tool may help you decide if it’s a good option for your business: Business finance guarantee scheme (BFG)Available during Levels: 1, 2, 3, 4 Are you after a loan? Business Finance Guarantee loans that can help businesses access credit for cashflow, capital assets, and projects related from impacts caused by COVID-19. What do you need to know? Due to a change in the scheme, businesses can now use the loan to modify their premises to accommodate different alert levels or meet changing demands. As per usual loan conditions, borrows are still liable, and debt must be paid back with interest. Find Out MoreAs always there are eligibility requirements that must be meet for you to receive financial support. I’m here to help, contact me if you have any questions or want to explore your options.

For a general guide on each of the above head over to the Business Govt. NZ website. Ring-Fencing of Rental Losses

The proposed loss ring- fencing rules will mean that speculators and investors with residential properties will no longer be able to offset tax losses from those properties against other income for example, salary, wages or business income to reduce their tax liability. The losses can be used in future years when the properties are making profits or if the person is taxed on the sale of land. Under the current New Zealand tax setting, tax is applied on a person’s net income. We do not ring- fence income and losses from particular activities or investments. This means that there is generally no restriction on losses from one source reducing income from another source. Investment housing is currently taxed under the same rules that apply to investments. This means that rents are income and interest and other expenses are deductible. Capital gains on sale of the property are not taxed unless the property is on revenue account ( for example, land dealer or developer) Aim of the proposed changes The introduction of loss ring –fencing rules is aimed at levelling the playing field between property speculators/investors and home buyers. Currently, investor’s particularly high geared investors have part of the costs of servicing mortgages subsidised by the reduced tax on their other income sources helping them to outbid owner occupiers for properties. Rules that ring fence residential property losses so they cannot reduce tax on other income , and is intended to help reduce this advantage and unfairness. Types of properties subject to the rules It is proposed that the loss- ring fencing will apply to residential land. The rules will not apply on a person’s main home, a property that is subject to mixed assets rule for example a bach that is sometimes used privately and sometimes rented out and land that is on revenue account because it is held in a land related business. Portfolio basis It is suggested that the loss ring fencing rules should apply on a portfolio basis. That would mean that investors would be able to offset losses from one rental against rental income from other properties calculating their overall profit or loss across their potfolio. Using ring fenced losses Under the suggested changes, a person’s ring fenced residential rental or other losses from one year could be offset against their:

It is proposed that the loss ring fencing rules will apply from April 1, 2019 next year. New Square Rate Option for Claiming Use of Home Claim Expense for 2018

A new method will be available for the 2017-18 and later income years to calculate the expenses you can claim for using your home as an office. This method will use rates that Inland Revenue will determine based on the average cost of utilities per square metre of housing, but excluding mortgage interest, rates and rent. You will be able to claim a portion of the mortgage interest, rates and rental costs that you paid during the year based on the percentage of floor area being used for business purposes. The square metre rate for the 2017 - 2018 income year is $41.10 per square metre. You still need to give me your annual mortgage interest /rent but you don’t need to give me information on your utilities. |

Archives

February 2024

Categories

All

|

OUR PARTNERS

RSS Feed

RSS Feed