Expert Insights from Caffeine & Coins with CristinaWelcome back to another episode of "Caffeine & Coins with Cristina," where we blend financial wisdom with your favorite cup of coffee. In our current economic climate, marked by the Covid-19 pandemic's profound impact, we're seeing a significant shift in debt collection dynamics, including a rise in winding-up proceedings, both in New Zealand and globally.

Understanding Insolvency: A Two-Pronged Approach Insolvency can be understood through two primary financial scenarios:

Support from the Inland Revenue Department (IRD) In these challenging times, the IRD steps in to offer crucial support to businesses impacted by Covid-19 through various financial relief options:

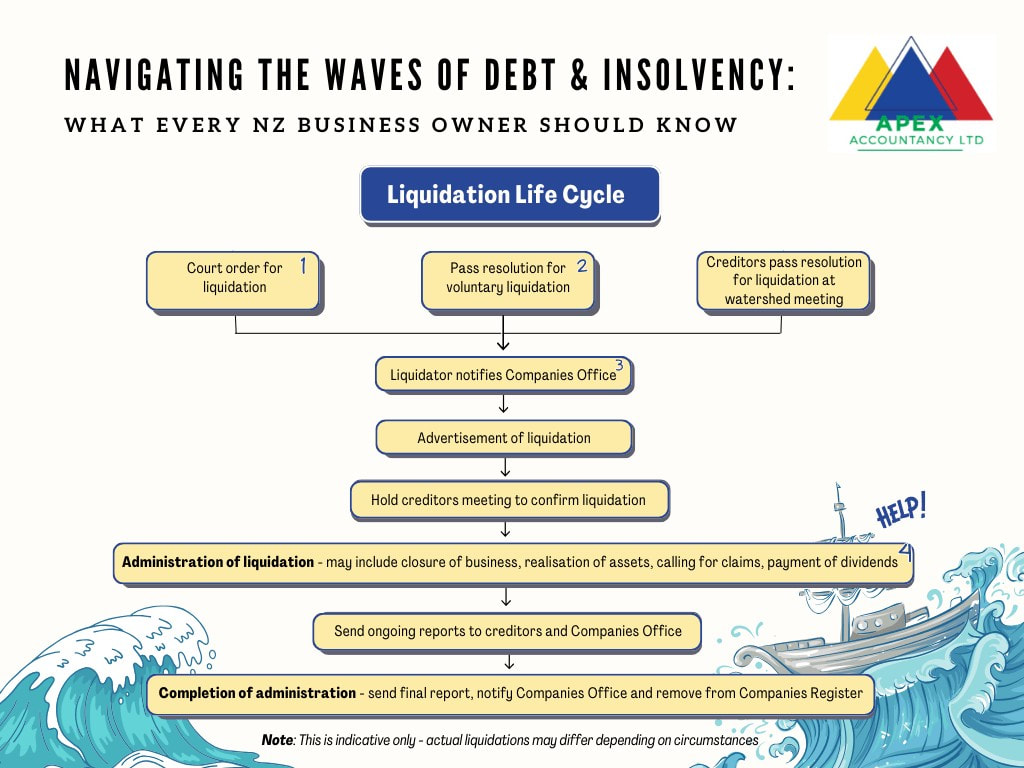

Additionally, the IRD holds the discretion to write off debts deemed irrecoverable, aligning with the efficient use of Inland Revenue's resources. Remission of Penalties and Interest In certain situations, penalties and interest may be waived, particularly when circumstances are beyond control, as part of the IRD's commitment to maximizing net revenue. Voluntary Liquidation: A Proactive Option Faced with formal demands from the IRD, companies can opt for voluntary liquidation, allowing directors and shareholders to maintain control. However, failing to act promptly might result in the IRD appointing a liquidator, diminishing the directors' control and necessitating cooperation with a Court-appointed liquidator. Choosing the Right Path Forward Deciding between involuntary and voluntary liquidation can be complex. Engaging a licensed insolvency practitioner can provide clarity and guidance in navigating these choices, minimizing impacts on the business. Key Considerations in Debt and Insolvency

In financially uncertain times, proactive measures and informed decisions are key. Seeking professional advice is crucial in safeguarding your business's future. Government Agencies for Assistance In New Zealand, two primary agencies offer support in insolvency matters:

Both agencies offer tailored support to help secure your business's future. For more information, visit Insolvency and Trustee Service or the Inland Revenue Department (IRD). Stay tuned for more in-depth analyses and clear guides on complex financial issues, helping you make well-informed decisions for your business. If you need help with this or any other tax or financial issues please get in touch. Comments are closed.

|

Archives

May 2024

Categories

All

|

OUR PARTNERS

RSS Feed

RSS Feed